Paul Krugman, Nobel Prize winning economist turned NYTimes blogger and public intellectual, has written extremely interestingly about Europe’s economic problems, provokingly titled “Greece as Victim”.

Paul Krugman, Nobel Prize winning economist turned NYTimes blogger and public intellectual, has written extremely interestingly about Europe’s economic problems, provokingly titled “Greece as Victim”.

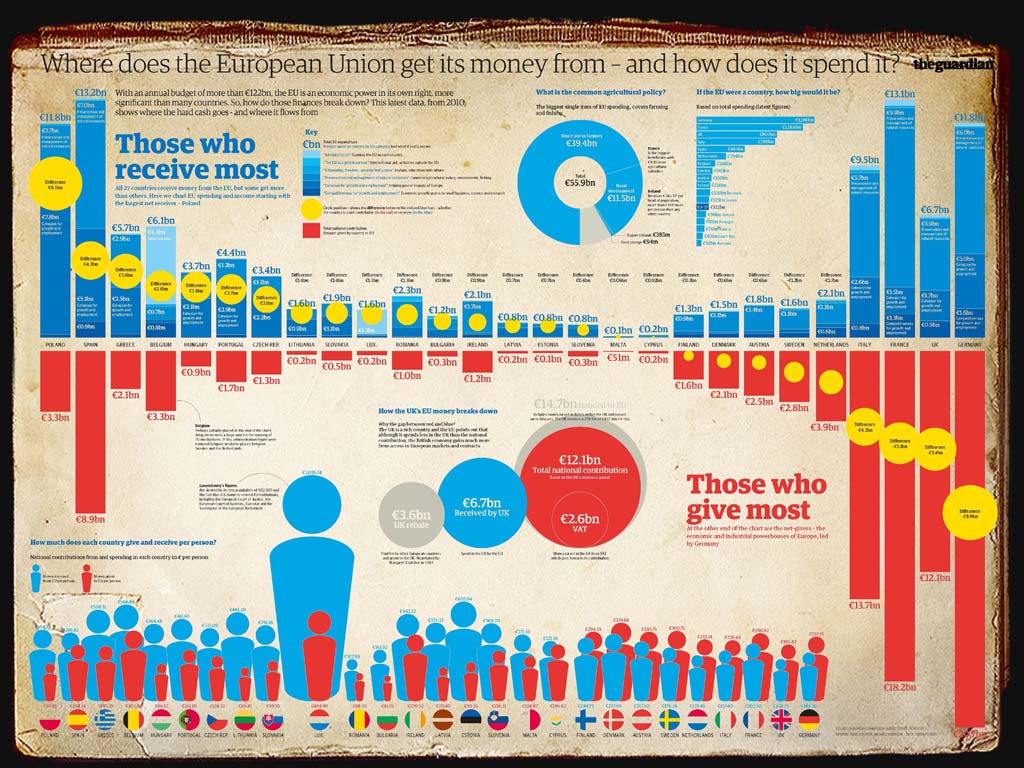

Again, I have to agree with him on most points, although I would not like to take a position on whether ECB should result to quantitative easing or not. In fact, as of now, I remain slightly skeptical of that suggestion. Nevertheless, I agree with Krugman that while Greece has its sins, it is primarily in trouble due to its Eurozone membership. Something that I actually highlighted already back in spring 2010. It is also true that Greece’s welfare state was not dis-proportionally large, as sometimes claimed. What Krugman, however, forgets is that no-one ever forced Greece to join the Eurozone.

Several pre-Maastricht Treaty EU member states have not done so. Indeed, Greece could have negotiated similar opt-out as did UK and Denmark. When it became clear that Greece was not going to adopt Euro immediately in 1999 when it was introduced to world financial markets as an accounting currency (Euro coins and banknotes entered circulation on 1 January 2002), Greece’s government decided to approach their public finance auditing creatively – just to make Greece fit for the entry criteria into the zone. In other words, Greek politicians were so eager to take their country into Eurozone that they were willing to result to fraud. Part from ideological reasons (integrate Greece more thoroughly with Europe), there were probably other motivations behind this move too. One that I can speculate, was to enable more generous public spending (due to lower interests rates that Euro brought with it). Among other things, more public spending stimulated the economy and reduced unemployment, thereby increasing government’s popularity. It also allowed ruling politicians to reward their “clients” in the lower levels of government bureaucracy with jobs and pay-rises. In that sense, claiming that Greece is somehow a victim, is simply not justified.